What You Should Know

- Personal auto insurance doesn’t cover when you are driving for business purposes

- If you ignore the different types of insurance, it can cost you a lot of money

- You should have commercial auto insurance if you drive your vehicle for business purposes

Commercial auto insurance can avoid a headache if you drive your car for business purposes. Everyone should have auto insurance, whether you are a delivery driver or an entrepreneur. Usually, personal auto insurance doesn’t cover an accident or incident caused at work.

Can you get auto insurance for a car used for business purposes? Choosing the best auto insurance can be confusing, and you must understand when you need more than a personal auto insurance policy. In this article, you will determine whether you need special insurance coverage to use your car for work.

Choose the Right Auto Insurance for Business

To identify the best coverage, you need to know why the rules differ for each auto insurance type.

Driving a personal car for business might feel like a regular routine, and sometimes it’s not noticed that auto insurance varies when the accident or incident happens in different situations.

However, if you lie about what you were doing or how it happened, you can lose your entire contract and waste more money.

Furthermore, you can contact your auto insurance agent or broker to find the best affordable auto insurance companies. Besides, working with a single skilled insurance broker can benefit you by getting a package discount.

Business Trips and Car Insurance Rates

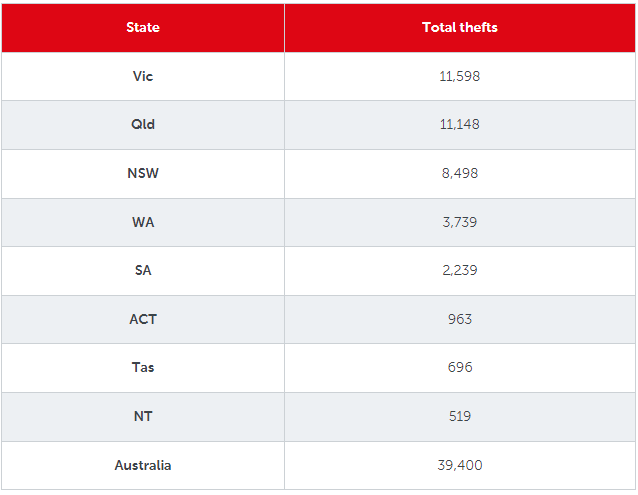

Please note that changing states can hugely affect your car insurance rates. The cost can be dramatically higher in some states or metropolis. Be sure to choose the right one according to your needs if you frequently travel from one state to another and how long you stay in these places.

Plan your business or personal trip according to your auto insurance. If you have questions, you should ask before the trip.

Auto insurance is required by law in most of the 50 states, so you need to know the answer to the question, why are auto insurance rates higher in some ZIP codes? Also, be aware of the differing costs from state to state and metropolitan areas.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Commercial Auto Insurance is Needed

What if you are going to make a working visit to someplace, and then an accident happens? Do you have commercial auto insurance or personal car insurance? Does it cover the situation?

Suppose you were driving your car for business purposes and didn’t have Commercial Auto Insurance. In that case, you will not only be injured but spend a lot of money on one situation you could have avoided.

We know it can be tedious and too complicated to understand all insurance, but don’t worry about comparing rates. It’s possible to compare prices and packages for free at an insurance broker. For example, the monthly average payment for commercial car insurance is about $147.

Also, you can choose an affordable commercial auto insurance coverage that fits you. Nevertheless, your policy is enough in a few situations on your workday, such as grabbing food or coffee for a co-worker, occasional business meetings, and a single delivery for your boss.

Auto Insurance for a Car Used for Business Purposes

Therefore, for any vehicle used only for business purposes, it’s recommended to have commercial auto insurance. The company invests in this insurance for their cars, and you can ask them to provide one if you often drive your vehicle for business purposes. Self-employees are included.

Note that having a vehicle used for business purposes isn’t mandatory to be in a business person’s name. Also, remember that you can be covered for property damages, medical costs related to treating injuries, and legal responsibilities.

Frequently Asked Questions

Who is included in your personal auto insurance?

Your family is included in the auto policy, whether driving someone else’s car (with permission) or your vehicle. Also, the same thing is valid if someone not on your family’s list is driving your car with your consent.

What is the average cost of commercial auto insurance?

The monthly average cost is about $147. It’s around $1764 per year for commercial auto insurance.

Is commuting to and from work a business purpose?

When an accident or incident occurs under this allegation, your auto insurance policy should cover it. It’s not considered a business purpose if you commute to and from work. However, if your job depends on your vehicle, you should have commercial auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance…

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

#auto #insurance #car #business #purposes