What You Should Know

- There are many potential consequences of a lapsed auto insurance policy, including fines and a criminal record

- There are steps you can take to reinstate coverage after a lapse

- Follow the necessary tips to avoid letting your auto insurance policy lapse

What happens if I let my auto insurance policy lapse? A policy lapse can lead to significant consequences, including fines, license suspension, higher premiums, and financial responsibility in an accident.

To avoid these issues, it’s essential to maintain continuous coverage and promptly address any lapses that occur. This is so your auto insurance policy can do what an auto insurance policy does best.

By staying diligent and working closely with your insurance company, you can protect yourself and your finances while enjoying peace of mind with proper coverage.

The Consequences of Letting My Auto Insurance Policy Lapse

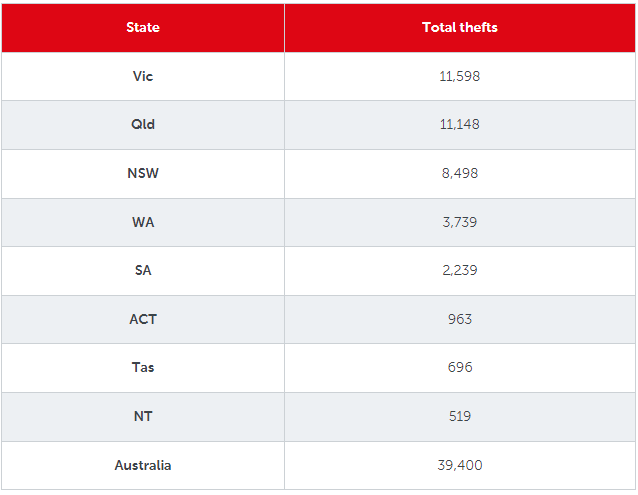

Several things happen if you let your auto insurance policy lapse. The consequences vary depending on the state you’re driving in, but most states require drivers to maintain a minimum level of auto insurance coverage.

You could face fines and penalties if your policy lapses and you’re caught driving without insurance. These fines vary by state but can be pretty substantial, often ranging from $100 to $5,000 or more.

A lapsed auto insurance policy can also lead to suspending your driver’s license and vehicle registration. Depending on the state, the suspension can last for a predetermined period or until you provide proof of insurance.

In addition, allowing your auto insurance policy to lapse can also result in higher insurance premiums. Insurance companies view drivers with a history of coverage lapses as needing affordable high-risk auto insurance policies, meaning increased rates when you try to reinstate your policy or purchase a new one.

Lastly, if you’re involved in an accident while your auto insurance policy has lapsed, you could be held financially responsible for any damages or injuries resulting from the accident.

You don’t want to get into an accident without insurance. This could lead to significant out-of-pocket expenses, especially if the accident results in severe property damage or injury.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Steps to Reinstate Coverage After Letting Your Auto Insurance Policy Lapse

If you discover you’re no longer insured, you must reinstate your auto insurance coverage as quickly as possible. This is the best way to avoid any potential consequences.

Step #1 – Contact Your Insurance Company

Contact your insurance company as soon as possible to discuss your options. They may be able to reinstate your policy or help you find a new one.

Step #2 – Obtain New Insurance Coverage

If your insurance company can’t reinstate your policy, shop for a new one. While you may face higher premiums due to the auto insurance policy lapse, having coverage is essential to protect yourself from potential financial consequences.

Step #3 – Provide Proof of Insurance to the DMV

Once you’ve reinstated your auto insurance policy or obtained new coverage, provide proof of insurance to your state’s Department of Motor Vehicles (DMV). This will help ensure that your license and registration are not suspended due to a lack of insurance coverage.

Ways to Prevent Your Auto Insurance Policy From Lapsing

There are several ways you can prevent your policy from lapsing.

- Set Up Automatic Payments: One of the easiest ways to ensure your auto insurance policy doesn’t lapse is to set up automatic payments. By automating your payments, you won’t have to worry about missing a due date or forgetting to pay your premium.

- Keep Track of Your Policy Renewal Dates: It’s important that you know what time your auto insurance policy expires or is up for renewal and note it in your calendar. This will help you stay aware of upcoming payments and policy changes.

- Review Your Policy Regularly: Take the time to review your auto insurance policy at least once a year. This will help you stay informed about your coverage, deductibles, and any changes that might impact your premium.

- Communicate with Your Insurance Company: If you’re struggling to make a payment or need to change your policy, contact your insurance company. They may be able to help you find a more affordable approach, adjust your payment schedule, or provide other assistance to prevent a lapse in coverage.

- Update Your Information: Keep your insurance company informed of any changes in your personal information, such as a new address or vehicle.

Remaining diligent and ensuring your insurance company has accurate information helps ensure you receive policy updates and renewal notices to avoid unintentional lapses.

Final Thoughts on What Happens If You Let Your Auto Insurance Coverage Lapse

While some insurance providers may charge you a higher premium if you let your auto insurance policy lapse, some insurance companies may be reluctant to insure drivers with a history of coverage lapses.

By setting up automatic payments, keeping track of important dates, and communicating with your insurance company, you should be able to avoid such inconveniences.

Frequently Asked Questions

How long does a lapse in auto insurance coverage stay on my record?

A lapse in auto insurance coverage can stay on your record for 3-5 years, depending on the insurance company and state regulations. This could impact your ability to obtain affordable coverage in the future.

Can a lapse in auto insurance coverage result in a canceled policy?

Yes, an insurance company may choose to cancel your policy if you have a lapse in coverage. In such cases, you must shop around for a new policy, which may come with higher premiums due to your lapse history.

Is there a grace period for auto insurance payments?

Some insurance companies offer a grace period for premium payments, typically from a few days to a month. However, this varies between companies and policies, so reviewing your policy details or contacting your insurance provider for more information is essential.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance…

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

#auto #insurance #policy #lapse